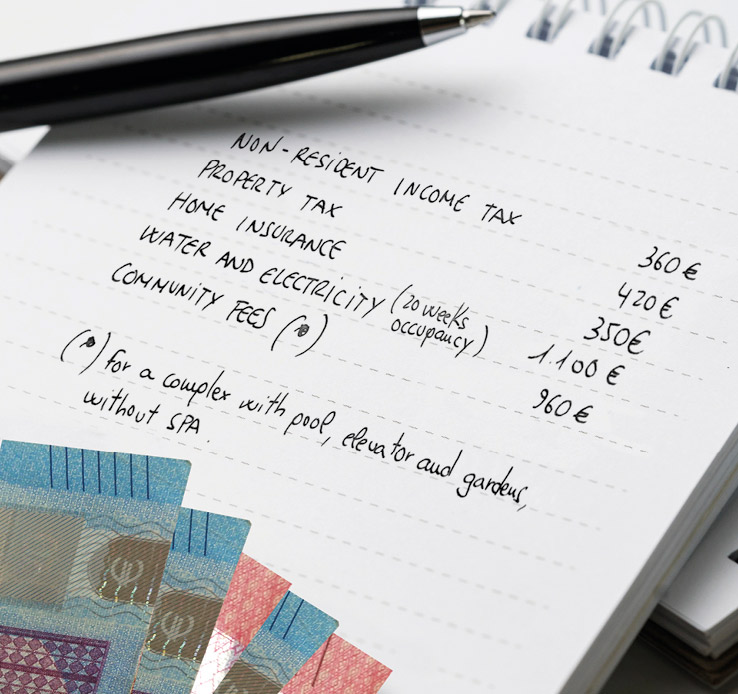

A Guide to Approximate Running Costs of Owning a Property in Spain

In general, the maintenance of a second property in Spain does not represent a great additional expense. In addition to general running costs, such as water and electricity supplies, the annual costs of taxes and other expenses depend on the size of the size and type of property.

IBI (Property Tax)

This is a municipal tax on the property, regardless of whom the owner is. It is calculated based on the Cadastral value (an administrative value, usually lower than the market price, sometimes considerably less) on which percentages established by the corresponding Council are applied. The sum involves ranges from 150 to 400 euros per annum.

IRPF (Income Tax)

If a new property is your “habitual/permanent” residence it will be exempt from income tax. If, however, it is a second home it will be taxed as what is called property income tax on your Annual Income Tax statement.

The tax base of the income tax will be 1.1% of the Cadastral Value if this has been recently revised, or 2% if it has not been revised. If a Cadastral Value has not yet been assigned to the property, then 1.1% of 50% of the purchase price applies. The result of this calculation will be applied to the general tax rate corresponding to each taxpayer.

For example, if a property has a Cadastral Value of 100,000 euros, the tax will be calculated as follows: Income Tax (IRPF): Tax base=1.1% of the cadastral value (100,000 euros) = 1,100 euros. The amount of the tax will be the result of applying each taxpayer’s tax rate to this figure. For example, if your tax rate is 19% (general tax rate for EU citizens as non-residents in Spain), the income tax will be € 209 a year.

In addition to the taxes associated with home ownership (IBI and Non-Resident Tax), the following must be considered:

Homeowners’ Association

If a property forms part of a complex, residential development or building in which there are common areas, each owner must, by law, be a member of the Homeowners’ Association. An annual budget of the common maintenance expenses will be approved at the general assembly of the homeowners’ association. Each owner will pay a service charge otherwise known as a community fee, generally between €45 and €120 a month. The amount depends on the number of owners and the type of common facilities in the complex, such as a swimming pool, lift, or spa.

Insurance

The cost of home insurance depends on the features of the building and its facilities. It is usually between €180 and €380 a year, for an average property type.

Pool / Garden Maintenance

This would only apply to villas and certain townhouses with a pool. There are companies that specialise in this type of service and they will visit your property once a week taking care of cleaning and chemical treatment for the pool.

So, what expenses do I have to face each year?