Taxes and Legal Costs of Buying a Property in Spain

If you purchase a new property, the main tax paid on the operation is IVA (Value Added Tax), currently established at 10% for new properties, applicable also to garages and storage rooms purchased jointly with the home. IVA is paid directly to the developer on each payment made. There is also a second tax called AJD (Stamp Duty) which is payable when you sign the deed of sale in the presence of a Notary Public and which currently represents 1.5% of the property’s value in the Valencia Region – (2% in Murcia)

If you buy a used property the main tax you will have to pay is ITP (Property Transfer Tax), currently established at 10% in the Valencia Region and 8% in Murcia. This tax is paid when you sign the deed of sale.

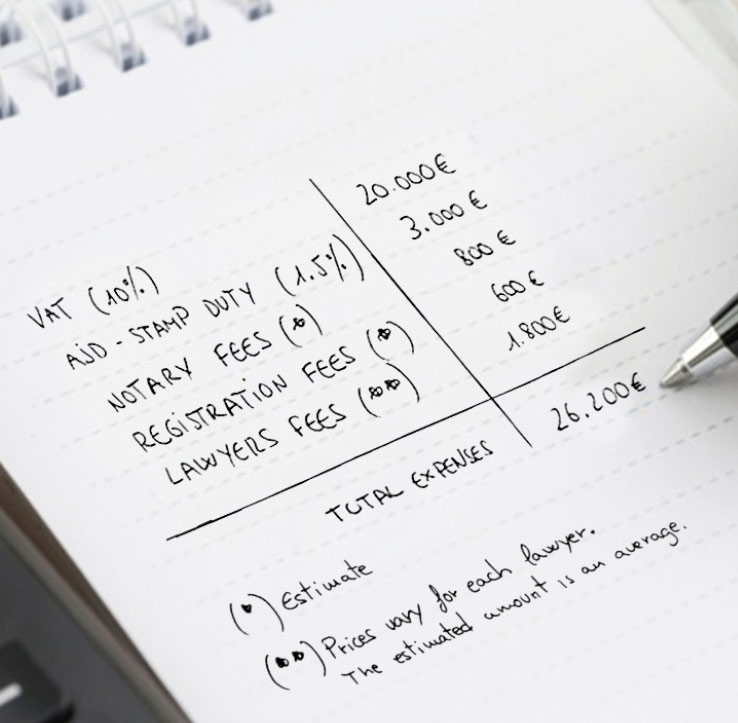

As you also must pay the Notary Public, Registrar and Lawyer’s fees, Medland recommends the addition of 14% of the net price of the property to work out the total cost of the purchase.

If you apply for a mortgage loan you will also need to consider the set-up fee and the cost of the mortgage appraisal report. The rest of the mortgage costs will be assumed by the bank. This can amount to an additional 1-2% dependent of the negotiation with the bank.

Below you can see an example of the breakdown of costs for a typical new build property with a price of 200.000 euros (without bank financing).